Owning and managing forestland in Oregon comes with unique responsibilities and opportunities. Understanding the intricate balance of legal requirements, financial strategies and future planning is crucial for ensuring your forest remains healthy, productive and resilient.

From complying with forest protection laws to leveraging tax benefits, the decisions you make today will shape the value and sustainability of your land. By understanding the intersection of laws, finances and legacy planning, you can confidently know your forest and make informed decisions to protect and grow its value for generations to come.

Forest protection laws

Learn about Oregon’s forest protection laws designed to promote sustainable practices and protect natural resources.

Taxes and business

Optimize your forest management business by understanding tax obligations, financial benefits and strategies for success.

Technical and financial assistance

Explore funding opportunities, grants and cost-sharing programs to help you invest in your forest’s future.

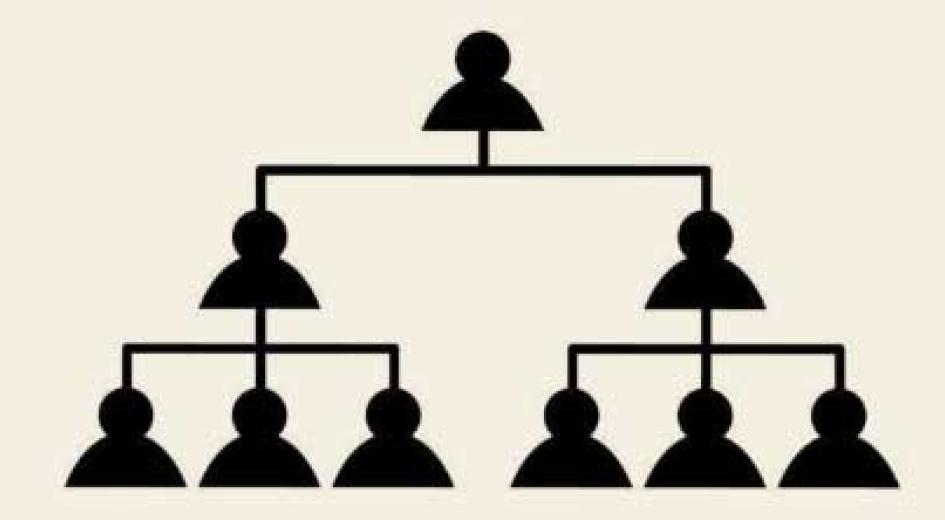

Succession planning

Prepare for the future with tools that help you guide family discussions, create legacy plans and transition your forest to the next generation.